Economic Aspects of Bitcoin Mining: Costs and Rewards Breakdown

Understanding Bitcoin Mining Basics and Its Importance

Bitcoin mining is the process of validating transactions on the Bitcoin network, ensuring security and integrity. Miners use powerful computers to solve complex mathematical problems, earning Bitcoin as a reward. This process not only generates new coins but also keeps the decentralized Bitcoin ecosystem functional and trustworthy.

Bitcoin mining is a complex process that requires significant investment, ongoing costs, and strategic planning to ensure profitability.

The significance of mining extends beyond just earning Bitcoin; it plays a crucial role in maintaining the blockchain. Each successful mining operation adds a new block to the chain, making it increasingly secure against fraud and cyberattacks. The more miners participate, the more decentralized and resilient the network becomes.

Related Resource

With the increasing popularity of Bitcoin, understanding the mining process and its economic implications is essential for potential investors and enthusiasts alike. As we delve into the costs and rewards, you'll see how this fascinating process intertwines with the broader financial landscape.

Initial Costs: Equipment and Setup Expenses

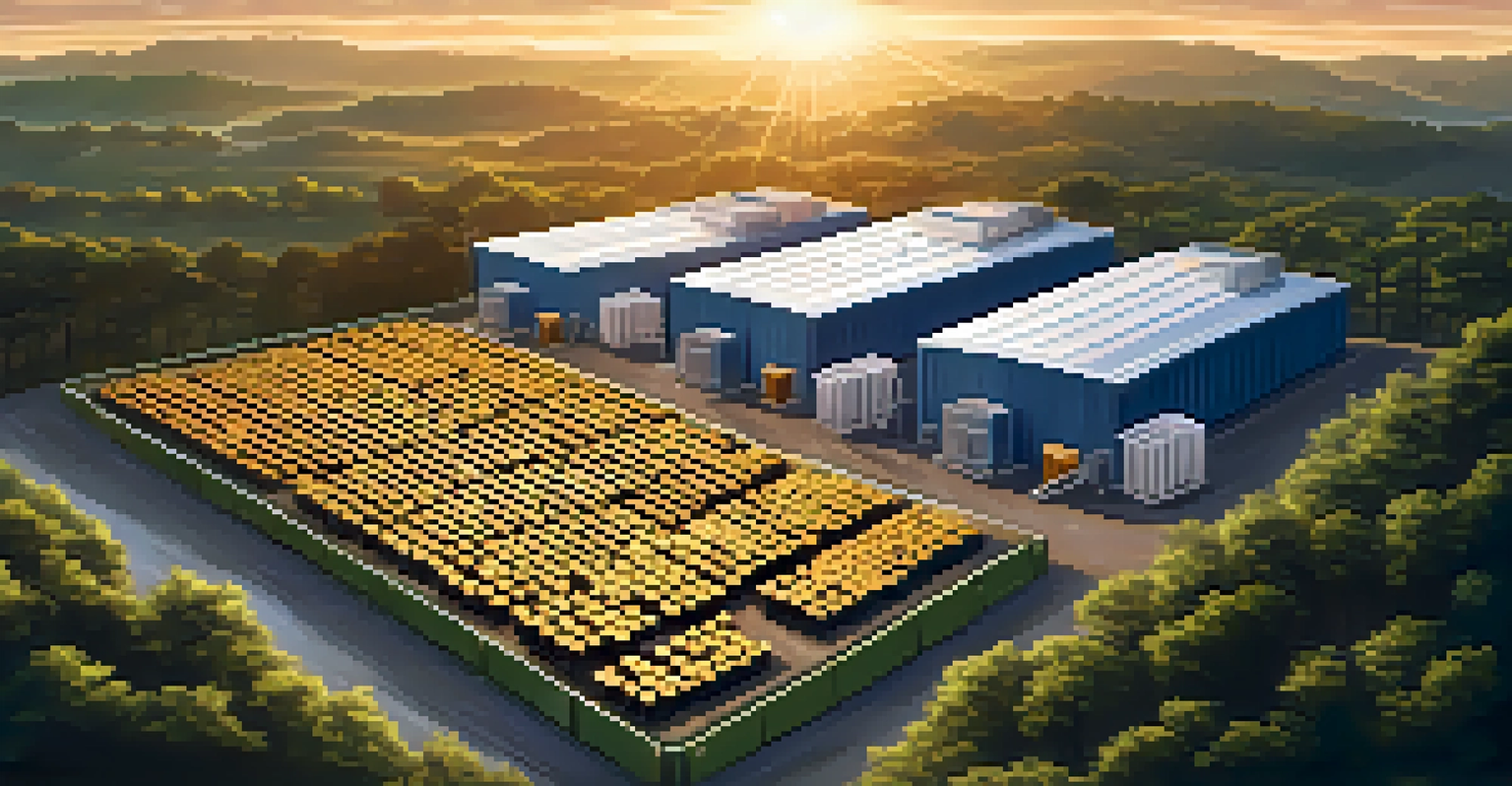

One of the first hurdles in Bitcoin mining is the initial investment in equipment. High-performance mining rigs, often specialized ASIC (Application-Specific Integrated Circuit) machines, can range from a few hundred to several thousand dollars. Additionally, miners must consider cooling systems and other hardware necessary for optimal performance.

Beyond hardware, there are also costs associated with setting up a mining operation. This includes sourcing a reliable internet connection, securing a suitable location with adequate power supply, and potentially even obtaining permits depending on local regulations. These initial expenses can quickly add up, making it essential to calculate potential returns carefully.

Bitcoin Mining's Essential Role

Bitcoin mining validates transactions and maintains the blockchain's integrity, ensuring a secure and decentralized network.

It's important to note that the mining landscape is constantly evolving. New technology can emerge, requiring miners to upgrade their equipment to stay competitive. This ongoing need for investment can significantly impact profitability, highlighting the importance of thorough financial planning in the mining venture.

Ongoing Costs: Energy Consumption and Maintenance

Once a mining operation is up and running, ongoing costs primarily revolve around energy consumption. Bitcoin mining is notoriously energy-intensive, with operations often requiring significant electricity to power the rigs and keep them cool. Depending on location, electricity rates can either enhance or diminish overall profitability.

The future of Bitcoin mining will depend not only on market dynamics but also on regulatory developments and community engagement.

In addition to energy bills, there are other maintenance costs to consider. Regular upkeep of the mining equipment is essential to ensure efficient operation and longevity. Factors like dust buildup, heat exposure, and hardware wear can lead to unexpected expenses if not properly managed.

Related Resource

Understanding these ongoing costs is crucial for miners. By calculating potential profit margins while factoring in energy and maintenance, miners can make informed decisions about their operations and evaluate whether their mining activities will yield a favorable return on investment.

Profitability Factors: Bitcoin Price and Mining Difficulty

The profitability of Bitcoin mining is heavily influenced by the market price of Bitcoin. When prices soar, mining can become highly lucrative, encouraging more miners to enter the space. Conversely, a drop in Bitcoin's value can squeeze margins, making it challenging for miners to break even on their expenses.

Another key factor is mining difficulty, which adjusts approximately every two weeks based on the total computational power of the network. As more miners participate, the difficulty increases, requiring more resources to mine the same amount of Bitcoin. This dynamic can create fluctuations in profitability that miners must navigate carefully.

Costs Impacting Mining Profitability

Initial and ongoing expenses, such as equipment and energy consumption, significantly influence the profitability of mining operations.

Ultimately, understanding these factors can help miners develop strategies to maximize their returns. Staying informed about market trends and adjusting operations accordingly can mean the difference between profit and loss in the volatile world of Bitcoin mining.

Potential Rewards: Bitcoin Earned and Block Rewards

The most direct reward for successful Bitcoin mining is, of course, the Bitcoin earned. Every time a miner successfully adds a block to the blockchain, they are rewarded with newly minted Bitcoin. This reward is halved approximately every four years in an event known as 'the halving,' which impacts potential earnings significantly.

In addition to the block reward, miners also earn transaction fees from users who want their transactions processed quickly. As the Bitcoin network grows, the number of transactions increases, potentially enhancing miners' overall earnings through these fees. This dual reward system can create a solid income stream for dedicated miners.

Related Resource

However, as the mining landscape evolves, miners must remain adaptable to changes in reward structures. Keeping an eye on future halving events and potential shifts in transaction fees will be crucial for miners looking to sustain profitability in the long run.

Economic Implications of Bitcoin Mining on Local Communities

Bitcoin mining often has interesting economic implications for local communities. In regions with lower electricity costs, mining operations can thrive, bringing economic activity and job opportunities. This can lead to a boost in local economies, as miners may invest in infrastructure and services.

However, the environmental impact of mining should not be overlooked. High energy consumption can strain local power grids and lead to increased electricity prices for residents. Communities must weigh the economic benefits of mining against potential drawbacks to find a balanced approach.

Market Factors Affecting Rewards

The profitability of Bitcoin mining is heavily influenced by Bitcoin's market price and mining difficulty, requiring miners to adapt their strategies.

Ultimately, fostering a dialogue between miners and local stakeholders is essential. By collaborating and addressing concerns, mining operations can potentially create a positive economic impact while minimizing disruptions to local resources and infrastructure.

Regulatory Factors Impacting Bitcoin Mining Economics

The regulatory landscape surrounding Bitcoin mining is rapidly evolving and can significantly impact the economics of mining operations. Different jurisdictions have varying regulations, which can either encourage or hinder mining activities. For example, some regions offer tax incentives for miners, while others impose strict regulations that may increase operational costs.

Staying compliant with local laws is paramount for miners to avoid potential fines or operational shutdowns. Additionally, regulatory changes can affect the overall market dynamics of Bitcoin, influencing prices and profitability. Therefore, miners must remain informed about both local and global regulatory trends.

As the industry matures, the need for clear and supportive regulations becomes increasingly important. Engaging with policymakers and advocating for balanced regulations can help shape a favorable environment for Bitcoin mining, benefiting both miners and local communities.